- Solutions

-

Products

-

Resources

Sales Automation: What It Is, How It Works, and What to Automate First by Kristi Campbell View all Blog Posts >Get the App, Get the Sidebar, & Get Your Trial Going HereUnleash limitless growth opportunities by partnering with Cirrus Insight.

- Pricing

Filter By:

- All topics

- Sales Intelligence

- Salesforce

- Sales Productivity

- Sales Strategy

- Sales Prospecting

- Book More Meetings

- Sales Activity Data

- Company News

- Sales Leadership

- Sales Metrics

- Team Scheduling

- Prospect Smarter

- AI

- Serious Insights

- Comparison

- Conversation Intelligence

- Sync To Your CRM

- Email Blast

- Email Campaigns

4 Ways Private Wealth Management Firms Excel At Client Experience

The rise of technology to the client and the organization is causing a disruption in the marketplace. Wealth Management Firms can no longer look the other way at new technology that will impact their clients, their advisors, their business, and their bottom line.

With the economy experiencing long-term cycles caused in part by changing demographics, regulations have increased, competition has intensified, and clients are more demanding. [BCG. Global Wealth 2017: Transforming the Client Experience. 2017] Because of these collective pressures, the roles of wealth advisors and relationship managers (or Relationship Managers) are changing.

To differentiate their services, wealth management firms must offer a better client experience. To protect margins, they must find ways to do so utilizing simple, smart, and seamless solutions that increase efficiency. The rise of FinTech has allowed firms to maintain high levels of efficiency while improving the client experience.

Four Ways Firms Succeed At Client Experience:

1) Understand The Digital Preferences of Today's Client

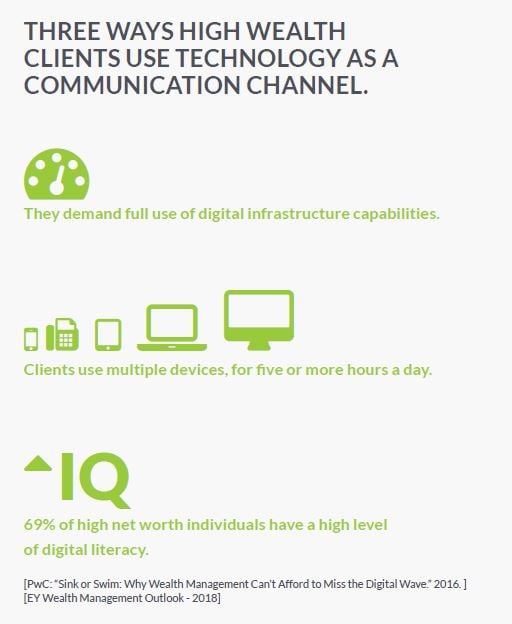

Digital preferences. The new generations of wealthy clients are more technically savvy than earlier generations. Individuals with high net worth want a digital experience.

Fully 69% of high net worth individuals (HNWIs) have a high level of digital literacy, PwC says. [PwC: “Sink or Swim: Why Wealth Management Can’t Afford to Miss the Digital Wave.” 2016. ]

They use multiple devices, and they use them for five or more hours a day.

They have smartphones and use apps. They shop online. And they demand “full use of digital infrastructure capabilities” from their wealth managers. While wealth management will remain a people business, EY predicts, digitally enabled production and advice will be important. They are likely to be especially important for high net worth individuals (HNWIs). [EY Wealth Management Outlook - 2018]

2) Leverage Technology To Reduce Risks

Risk and compliance play a huge role in how firms operate. Client information and data is at the forefront of the risks and without the right technology to collect, track and analyze client information, firms are opening the doors to risks.

3) Create An On-Demand Experience For Client Meetings

With technology, BCG says, wealth managers can “design advanced, high-impact client journeys from front to back — creating a new generation, 2.0 version of the client experience.”

Nevertheless, BCG says, many firms “have failed to provide even a minimum level of client-facing digital technology.” And many wealth managers are “still trying to make old ways of doing business continue to work in the new environment.” [BCG]

4) Create A 360 Degree View Of The Client

Centralized Client data and information is a critical path towards team agility. Client data, insights, and preferences should be only a click away for the entire team and easily accessible within the

work environments where Advisors and relationship managers live.

Are you a wealth management firm looking to leverage technology to better serve your clients? Read more about the fours ways firms can excel at client experience and how three successful firms are succeeding at it today. Access a copy of the eBook that will take you into a deeper look at the fours ways and some actions firms can take today to provide a better client experience.

.png?width=1268&height=1772&name=Sidebar-C%20(1).png)